Our Solutions for your Business

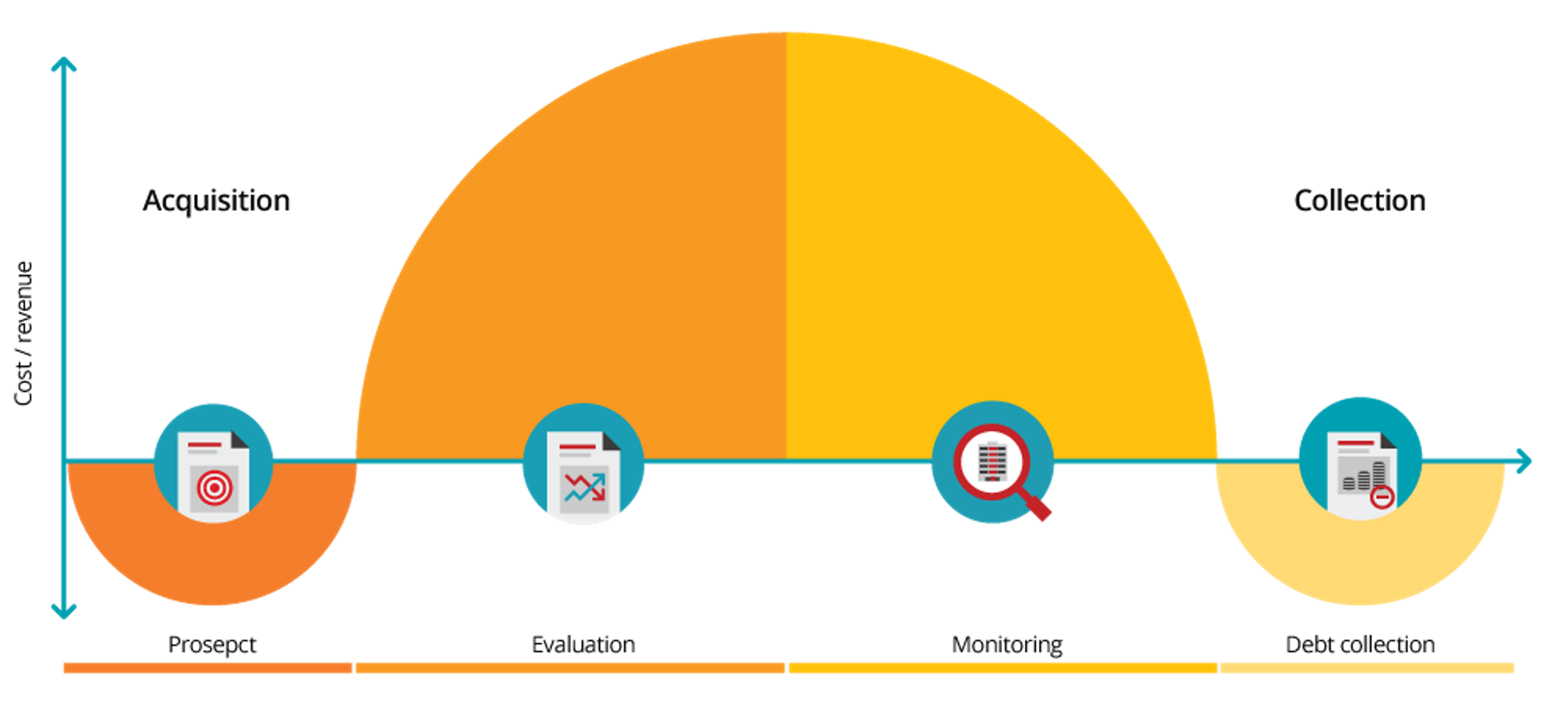

Automate and enhance your decision-making process through advanced analytics. Credit risk scorecards are statistical models used to assess your customers’ risk at each point of the credit cycle. Scorecards produce a ranking of customers by risk levels by leveraging your data. Once integrated with lending strategies, credit scoring helps to perform fast, accurate and transparent decisions. We believe that with our successful track record of similar solutions in a variety of markets all over the world, as well as the deep experience of our team, we are able to add significant value to your business.

Our Solutions for your Lending Business

Credit Report Plus

The EveryData Credit Report Plus is a comprehensive tool that increases your speed and efficiency in granting loan approvals. Inclusive of the benefits of our AI-based Credit Scoring model, Credit Report Plus draws on our credit information database to paint a complete picture of prospective borrowers' creditworthiness.

Market Insights

EveryData's Market Insights is a suite of reports, graphs, and statistics that show your performance across key measures for sales activity and delinquency relative to your industry. It gives insights into the general market performance and makes comparisons with your competitors.

Portfolio Monitoring

Your customers’ credit status constantly changes, and, by monitoring these changes, you can make more-informed business decisions and identify new opportunities. With EveryData’s Portfolio Monitoring service, you can enhance your risk management processes, protect yourself from losses and increase low-risk sales. You will be instantly notified of changes to the customer profile allowing you to make optimal business decisions proactively.

ID Verification

Today’s ID-checking processes offer sophisticated, real-time verification methods so that you can quickly spot ID fraud without inconveniencing genuine customers. Our Digital Onboarding solution also brings you a completely customizable KYC process built around automated Identity Validation & Verification according to industry next and best practices.